Growing Global Expectations for Ion Implanters

Promoting global strategies in the SDGs era

Winner of the Grand Prix at the Semiconductor of the Year Awards

In 2021, IMPHEAT-II, launched in 2019, won the Grand Prix in the semiconductor manufacturing equipment category at the Semiconductor of the Year 2021, sponsored by the Electronic Device Industry News. The award was given in recognition of the innovative development, the establishment of a mass production system, and the impact it has had on society (including its contribution to achieving carbon neutrality). Attending the award ceremony was Tadashi Ikejiri, General Manager of the Ion Beam Business Division, who has been leading the development of ion implanters for SiC power devices. Ikejiri has played a central role not only in development but also in sales and marketing.

“As SiC devices became the focus attention, we read the trend and started development early on, building a mass production system. The impact of our development and sale of ion implanters for SiC power devices was not small, and while I was stationed in the U.S. we received an inquiry from a major power device manufacturer and concluded a business deal. This was an opportunity for our products to gain attention both domestically and internationally. Since then, we have worked on the development of ion implanters for many years. I believe that the technology and knowledge we have cultivated gives us a certain advantage,” says Ikejiri.

Differentiation from the Competition to Develop the Market

Currently, NIC has a market share of approximately 90% in Japan and approximately 40% overseas in the market for ion implanters for SiC power devices. However, Takashi Sakamoto, General Manager of Semiconductor Equipment Department, points out that the competition is becoming tougher each year.

“Amid rising societal needs, such as achieving carbon neutrality, the number of entrants into the market for ion implanters for SiC power devices has increased. Take, for example, a huge US company that handles all types of semiconductor equipment. Our competitors are companies that are much larger than us. Some domestic companies are following suit. To win out, we will pursue technological superiority while also differentiating ourselves from our competitors by responding accurately and quickly to customer requests and improving our customer support system,” comments Sakamoto.

Ryohei Kataoka of the Marketing and Sales Department is the person on the front lines of sales, working to expand the sales of ion implanters for SiC power devices. He is responsible for the Asia region including Japan.

“In Japan, we have a high market share, and the stable operation of our products is highly rated by customers. In other parts of Asia, we are seeing an increase in business negotiations with customers in Korea and China. China has great potential for market expansion, and there are local manufacturers with large market shares, as well as Japanese manufacturers who have entered the market before us. The competition is getting fiercer each year. There are many SiC power device manufacturers, including small and medium-sized ones, so we feel it is necessary to identify companies with growth potential and markets where we will have success. I would like to promote the company’s advantages and take on the challenge of developing the Asian market,” shares Kataoka.

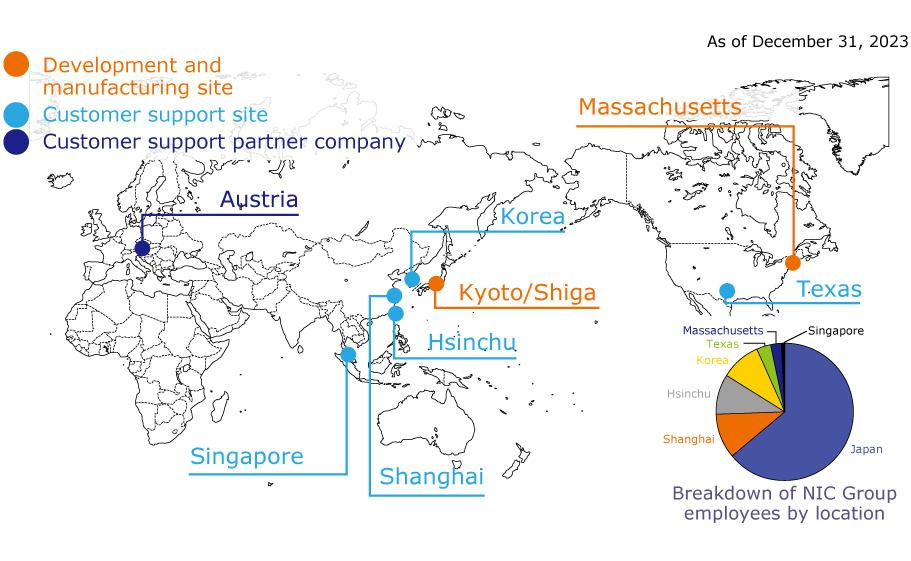

From the perspective of global strategy, the challenge lies in the European market. A customer support partner company based in Austria is the company’s only foothold in Europe. The company plans to increase its presence in Europe in the future by establishing its own business site and providing meticulous customer service and after-sales care.

Aiming to Reach 100% Market Share, Just Like Ion Implanters for FPDs

So far we have looked at ion implanters for power device manufacturing. Another of NIC’s main products is an ion implanter for flat panel display (FPD) manufacturing. Masashi Konishi, director in charge of this area, says he wants to develop the ion implanter for SiC power devices into a position similar to that for FPDs.

“Smartphones are one of the everyday products that incorporate FPDs. Ion implanters are essential for manufacturing FPDs, and the company has 100% market share for this equipment. High-definition smartphone displays would not be possible without the company. There were competitors in the past, but they gradually withdrew from the market. Similarly, we would like to reach 100% market share for ion implanters for SiC power devices. To achieve this goal, I believe it is important to take on new technologies and new markets,” says Konishi.

Under the Nissin Electric Group’s medium- to-long-term business plan “VISION 2025,” which was launched in April 2021, NIC is working on a growth strategy centered on the SDGs and strengthening the business foundation that supports it. The development and expansion of sales of ion implanters for SiC power devices is part of this effort. The company aims to evolve into a total supplier of innovative equipment, technologies, and services that utilize ion beam and plasma technology.

“Ion implantation technology is a key technology that will contribute to a sustainable global environment. We believe that providing the technology to the world will contribute to achieving carbon neutrality and lead to the creation of a society in which everyone around the world can thrive. It is an aspiration and a dream shared by all employees of the company. We will continue to implement initiatives where our business growth leads to contributing to society,” says Nagai.

The SiC power device market is expected to thrive even more in the future. This will result in a significant reduction in greenhouse gas emissions from electricity use. There is no doubt that NIC was a catalyst. As seen in the efforts of NIC, the Sumitomo Electric Group will seize every opportunity to promote activities aimed at conserving the global environment.

Registration of public notification

If you register your e-mail address, we will notify you when the latest issue is published. If you wish, please register from the registration form.

To delete your registration, please visit here.