Automotive

22VISION Ideal state

The world’s top share wiring harness supplier

Overview of Business

The automotive industry is undergoing a period of drastic changes, with the increasingly rapid adoption of CASE* and the entry of companies from other industries into the market. We are leveraging our global presence in 33 countries around the world and bringing together our global resources to contribute to advancement in mobility.

Our main product, wiring harnesses, are laid throughout an automobile. Advanced technology is required to produce harnesses that can transmit power and information reliably while withstanding extreme vibration and heat. The Sumitomo Electric Group greatly leads the world in harness development, with dominant top share presence in global market. We are steadily promoting the use of aluminum harnesses, which contribute to weight reduction in vehicles, and our connecting technologies are essential in realizing connected cars and autonomous driving, which must handle a huge amount of information, as well as in achieving widespread use of hybrid and electric vehicles. We will continue to contribute to the next generation, where automobiles are connected with people and society.

*A term for the trends in the automotive industry; an acronym for Connected, Autonomous, Shared and Electric

VISION 2022 Mid-term Management Plan: Segment Strategy

FY2020 Results

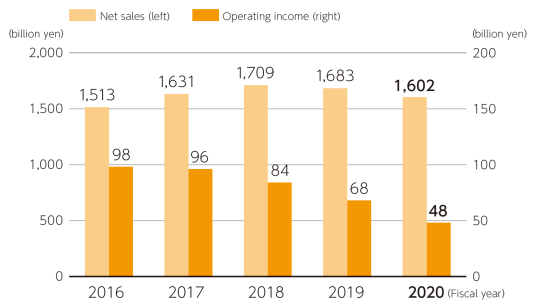

Due to a decline in demand for wiring harnesses, car electrical equipment, and anti-vibration rubber and hoses due to a drop in automobile production caused by the impact of the COVID-19 pandemic, mainly in the first quarter, net sales decreased by 81,588 million yen (4.8% year-on-year) to 1,602,042 million yen. Despite the implementation of all possible cost reduction measures, operating income decreased by 20,015 million yen to 48,198 million yen, not only due to the decrease in sales, but also due to the alternative production associated with the lockdown of some production bases and the increase in logistical expenditures associated with the rapid recovery in demand from the second half of the fiscal year.

Priority initiatives for FY2021

●Cost reduction activities that were implemented as countermeasures for COVID-19 will be maintained in the future, and we will further promote the construction of a muscular business structure that can withstand fluctuations in demand.

●Targeting“ mega-supplier” status, we will strengthen proposal based marketing for customers, accelerate the creation of new CASE*-related products and aluminum harnesses that are highly demanded by customers, and work to expand our share of overseas customers.

●While striving to restore profitability through deepening our global response and integrating/consolidating domestic and overseas business operations and reducing costs, we will also focus on the development of new products for next-generation automobiles.

Examples of our initiatives to solve social issues

High-strength aluminum wiring harness

We developed aluminum alloy electric wires that conduct electricity as effectively as copper while being around half as heavy.

We began selling our aluminum harnesses in 2010. After further discussion with automotive manufacturers, we began working to develop high-strength aluminum to meet a variety of needs. In 2015, we succeeded in developing high-strength aluminum alloy electric wires, which are stronger than copper and flexible and heat-resistant enough to meet manufacturers’ needs. Releasing high-strength aluminum wiring harnesses has made it possible to use aluminum wiring harnesses in areas with extreme vibration, such as around the engine. Our high-strength aluminum wiring harnesses are now used in many automobiles both in Japan and overseas. In addition to further contributing to improving fuel efficiency and reducing CO₂ emissions by making automobiles lighter, they are helping to conserve rare resources as aluminum reserves are more abundant than copper.